Conventional wisdom dictates that Apple and its expensive devices perform best in Western markets, where operator-subsidized contracts are commonplace and consumer spending power is greater. China aside, Asia has been a tough nut for Apple to crack, but it turns out the U.S. company is doing a lot better in India than many may have expected.

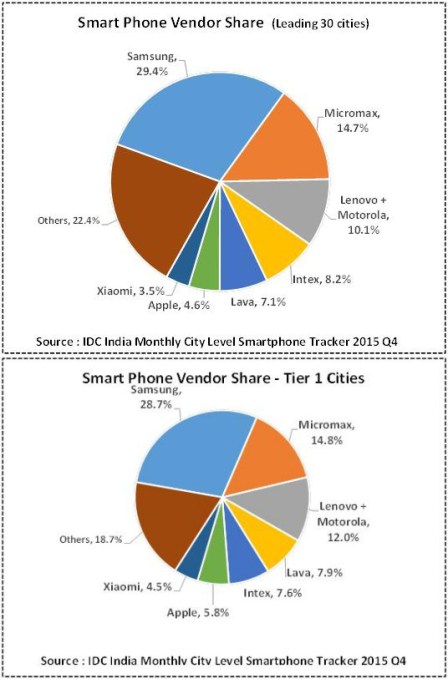

Apple accounted for less than one percent of smartphone sales nationwide in Q3 2015, but a new report from IDC found it racked up 4.6 percent of sales in India’s top 30 cities — which the analyst firm estimates account for 51 percent of country-wide sales — during the last quarter of business.

In fact, Apple’s share of sales is higher still at 5.8 percent if you look only at India’s tier-one cities. In addition, IDC claimed, the launch of the iPhone 6S and iPhone 6S Plus last year saw Apple retain the crown as the top seller in the $300-plus segment, hauling in 42.1 percent of the market despite the price of the devices in India initially being the highest in the world.

This is the first time that IDC has published figures that drill down to city-level in India, so it isn’t possible to analyze growth based on previous quarters. But, even standing alone, the data demonstrates that Apple’s recent decision to increase its focus on India — where it wants to sell refurbished older devices to stretch its pricing range, is working to open its own retail outlets, and has slashed prices — is coming for good reason.

With 220 million smartphone users, India is now a larger market for phone makers than the U.S.. But there are a couple of factors worth recalling when thinking about the opportunity for Apple and others in the high-end of the market.

Budget devices dominate when it comes to volume. IDC estimates that two-thirds of the smartphones sold in India’s tier-two and tier-three cities — which alone account for just over 20 percent of the market — are priced below $100. That’s a bracket that Apple simply doesn’t play in, even with older phones, and that’s why it is not among the top sellers based on nationwide marketshare. But the company has always emphasized higher margins, and financial indicators — such as its first billion dollar sales year and a 76 percent annual sales increase — show it is making progress in India.

Apple aside, the IDC report found that Samsung leads the field in urban areas, with 29.4 percent of sales across India’s top 30 cities and 28.7 percent in tier-one locations. Home-grown rival Micromax followed the Korean company in both of those rankings, ahead of a glut of Android makers and Apple. Interestingly, Xiaomi, which is placing significant focus on India, sold less than Apple in urban areas, according to IDC’s numbers, although the figures don’t represent all sales across the country.

Featured Image: Shanti Hesse/Shutterstock (IMAGE HAS BEEN MODIFIED)

Comments are closed.